Hunters’ expert letting agents really understand the lettings market and know that whether you’re a first-time landlord, or have rented out properties before, getting that property marketed and let, whilst ensuring everything is legally compliant, can be tricky.

With this in mind, we’ve created a Guide to Letting a Property, to arm you with all the information you need to let a property. From getting that first valuation to choosing an agent, understanding your landlord responsibilities to your new tenant moving in, we’ll guide you through the whole process and show you how Hunters can make letting a property a stress-free affair.

Access the Government’s How to Let Guide

The checklist for renting in England is updated frequently, including information on what to get together before considering letting, the financial implications involved, how to set up your tenancy right and what to do if things go wrong. Access the latest version here.

How to make money letting a property

With high demand for rental properties and some of the highest rental incomes to date, now is a great time to be a landlord.

However, before you start letting a property, there are a number of factors you should consider.

Letting with a mortgage

In most cases, a buy-to-let purchase is done with a buy-to-let mortgage. This is commonplace, but if you wish to let a property that has an existing owner-occupier mortgage, make sure you receive consent from your lender and insurance provider.

Letting income vs expenses

Income

The main reason you will probably be considering investing in property is to make money. There are two main ways in which you can do this via buy-to-let, the rent itself from the tenants, and through capital gain of the property value.

You must consider that through turbulent times it is possible to lose money if the value of your property decreases, you have long void periods or your outgoings are higher than the rent received. Like any form of investment, there are financial risks involved so it’s worth speaking to an agent about this risk before purchasing and letting a property.

Expenses

As with any property purchase, there are a range of fees associated with your purchase you must factor into your budget regardless of whether you’ll be letting a property:

- Stamp duty

- Property survey

- Legal costs

- Valuation fees from your lender

- Mortgage fees

- Income tax

As well as those fees paid largely up front before your purchase, you must also consider the ongoing charges you’ll have to bear as the landlord:

- Letting agent fees (fully managed service)

- Interest on your mortgage

- Insurance

- Safety checks

- Maintenance

- Rent insurance

Is letting an HMO property different to a non-HMO?

A House in Multiple Occupation (HMO) is a term used to define one that is owned by a private landlord and shared by multiple people. HMOs have different standards to non-HMOs, so getting good letting advice from a local agent before you proceed with an HMO is essential.

What is an HMO?

- A property is considered a House in Multiple Occupation if:

- Five or more people occupy the property

- Occupiers share facilities, such as lavatories and cooking areas

- The property can potentially house two or more households, no matter the number of storeys

What’s the difference between an HMO and non-HMO property?

The main difference between an HMO property and a non-HMO is that tenants can complain to the local council. If the Environmental Health Department of the local council does find fault with the standard of the HMO property, the landlord can be compelled to rectify the problem and the landlord and any property managers can be prosecuted – the council can even take over the property.

What are your landlord responsibilities with an HMO?

As well as your statutory legal responsibilities as a landlord you must ensure:

- Electrics are checked every five years

- The property should not be overcrowded

- Adequate cooking and washing facilities

- Communal areas and shared areas are clean and in good condition

- Smoke detectors installed

How to choose the right letting agent for you

Choosing a letting agent to either manage your property, or find your tenants, is an important first step, and we recommend starting this research early as there are several different options.

Before booking your valuation you should make sure you find the agent, you believe, can do the best job for you.

Create a shortlist of letting agents

It helps if you can get the list of agents you have to choose from down to three, then invite them out to do a valuation. To do this you should:

- Ask trusted friends and family – nothing is more powerful than someone you know offering their recommendation from recent experience.

- Compare local agents based on their recent reviews online. After friends and family, other consumers are your next best point of reference.

We encourage our lettings agents to work towards their HNQ qualifications from our TPFG Training Academy, and become members of safeagent (National Approved Letting Scheme) and ARLA (Association of Residential Letting Agents), reassuring you that your money is in safe hands.

Book a free rental valuation

When valuing your property, our agents will offer valuable insights on:

- Who will rent out your property? i.e. students, couples, corporates or families.

- Will it be furnished, part furnished or unfurnished?

- Current state of repair and any works needed

- Internal decoration – is it presented at its best?

- Proximity to shops, transport links and schools

- Is your property type in demand locally and will this change in the future?

Choose the right lettings’ services for you

Once you’ve chosen your agent, you need to consider how much involvement do you want with your property, tenant, rent collection and maintenance?

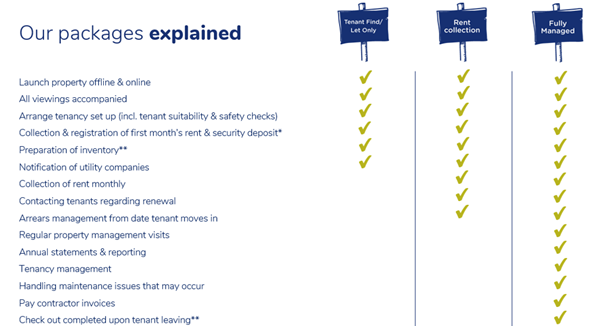

Our lettings services are set out in three categories: Fully Managed, Rent Collect and Tenant Find.

For details on what each service covers, please see the table below.

Our premium Fully Managed product includes all of the above, and:

- Monthly rent paid for up to a maximum value equivalent to fifteen months

- Cover provided for breaches of the tenancy agreement by the tenant, including non-payment of rent and expired section 21 notices

- Legal expenses up to £100,000 to cover eviction costs if the tenant is in breach of their tenancy agreement

- No policy excess meaning your rental payments are covered straight away

We always recommend taking this product, protect you, your investment and don’t take any risks.

The Hunters difference: why work with our letting agents

We’ll market your property effectively

We want to help you find the perfect tenant who is in a great position to rent your property. We know that there are 3 key factors for landlords:

• Getting you a quick let

• Achieving the best price

• Peace of mind that your property investment is in good hands.

Once the terms have been signed we will:

1. Instantly prepare your property details, complete with photographs, EPCs and floor plans and advertise your property on the major property portals including Rightmove and Zoopla.

2. We will upload your property to our website. Your property has 3 seconds to make an impression online. We will make sure your property is presented in the best possible way.

3. Contact our ‘Hot Tenants’ via phone and email and arrange viewings. We will ask you to share your live property link with your friends and contacts via social media.

You will also be given access to the My Hunters Landlord Portal, where you can follow the progress of your property let, track viewing feedback, access shared documents and see key dates for renewals plus much more.

We make sure your property meets the correct legal safety standards (certified gas inspections and EICR) as well as keeping up to date with UK legislations. If there is a possible upcoming change, we make sure this is communicated to our landlords.

We’ll find and fully-reference your new tenants

Our letting agents like to accompany the prospective tenants to view your property so we can point out the great potential it has and how it can suit them, however you do have the option of hosting the viewing yourself. As part of the service we offer, our letting agents can negotiate an agreeable offer between you and the prospective tenant and make sure we get the best possible price for you.

Once this is all agreed and your property is let, we’ll:

- Credit reference the tenants

- Prepare an inventory with photos

- Prepare your Tenancy Agreement

- Arrange the standing order

- Arrange a Gas Safety Certificate and EICR

- Ensure the property is ready for the tenant to move in.

What do landlords legally have to provide in a rental property?

Gas Safety Certificate and a Electrical Installation Condition Report

It is now mandatory to carry out an Electrical Installation Condition Report (EICR) before a tenancy begins and we also recommend you carry out regular Portable Appliance Tests (PAT) on all appliances at regular intervals. At the start of the tenancy you should provide a Gas Safety Certificate and EICR. If you do not provide this, you cannot evict a tenant using a Section 21 notice.

Smoke and carbon monoxide alarms

Regulation is now in place which requires all landlords to have at least one smoke alarm on each storey.

These must be working and in addition to this, any rooms with a solid fuel appliance (wood stove) you should also install Carbon Monoxide alarms.

On the first day of the tenancy, you must check these alarms; after that, the responsibility to check regularly lies with the tenant until their tenancy is over.

Energy Performance Certificate

Legally, you must have an Energy Performance Certificate registered to the property. In April 2018, regulation came in that meant a legal property must have a rating of E or above.

You must provides tenants with your EPC as early as possible and tenants can ask permission to improve the energy performance of your property and you cannot refuse consent. If the tenant is responsible for paying the energy bills, they can choose to have a smart meter installed.

Water safety

As a landlord you have a duty of care to your tenants to make sure your water supply is working properly to protect them from Legionella.

Furniture

There are three ways in which a property can be furnished when a tenant moves in:

- Unfurnished: This doesn’t mean leaving the property empty. Usually curtains, carpets and certain white goods will be included such as a fridge and cooker.

- Part furnished: Part furnished will usually include curtains, carpets, specific white goods and larger items such as wardrobes, beds, dining table and chairs.

- Fully furnished: This means the property is ready for move in. The specifics of what will and will not be included is down to the landlord and tenant to negotiate.

Setting up the tenancy and move in

The first thing you must do is provide your tenant with a tenancy agreement. We recommend you use our agreement but you may draw up your own, with professional advice.

Tenants should be given good chance to read and understand the terms of the tenancy, before agreeing to sign.

You should consider who is responsible for utility bills and council tax. In most cases, the tenant will pay for this, but it must be made clear in the agreement.

How to manage your let through the tenancy

The service level you have chosen will determine how much contact you will have with the property and the tenants once they have moved in. We can offer a Fully Managed service which will help minimise your workload as much as possible.

For a smooth move in process we recommend a neutral décor throughout, the removal of all your personal belongings, leaving instruction manuals for appliances and placing picture hooks for your tenants to use.

During the tenancy period, whatever the length of the tenancy, you have a responsibility to keep the property well maintained and in working order, fit for habitation in line with the Homes Act 2018 and ensure you arrange regular, annual gas safety checks.

You are now a landlord, letting a property for the first time. Congratulations! Get in touch with your local agent to get started.

Did you find our guide useful?

If you’re an existing landlord, or considering letting your property for the first time, we can help